As we start to build strategies for getting out the economic mess that has been created by the Coronavirus shock, it’s important to get everyone the management team using the same mental models about what the economic recovery will look like.

Economic analysts have built up a vocabulary that they use as shorthand to describe the different ways in which the economy could recover from this shock to the system. The shape of these recoveries makes a big difference in whether we recover quickly or slowly.

Knowing which type of recovery we experience should make a big difference in how you plan your actions going forward.

Sorted from most optimistic recovery scenario to least optimistic here is a quick overview of these different types of recoveries.

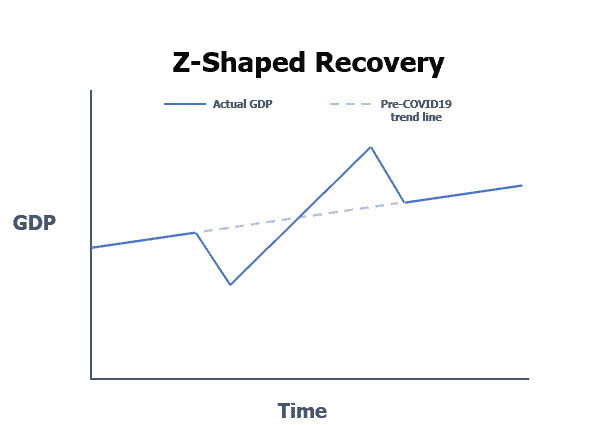

The Z-Shaped Recovery – We spend less this quarter, but make up for this spending decline by spending more next quarter.

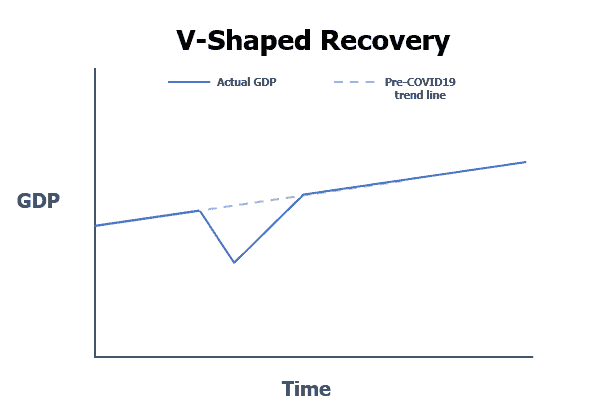

The V-Shaped Recovery – We spend less this quarter, but return back to the original trend line rather quickly.

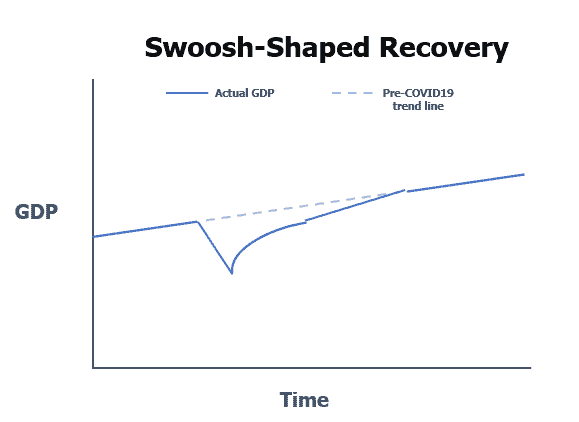

The Swoosh-Shaped Recovery – We spend less this quarter, bounce back but not all the way, and gradually return to the long term trend line.

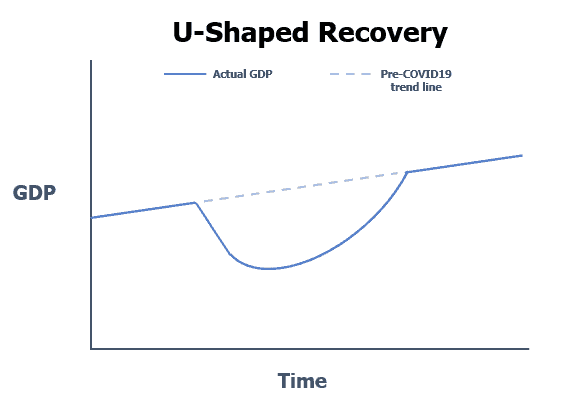

The U-Shaped Recovery – We spend less this quarter and gradually return to the long term trend line

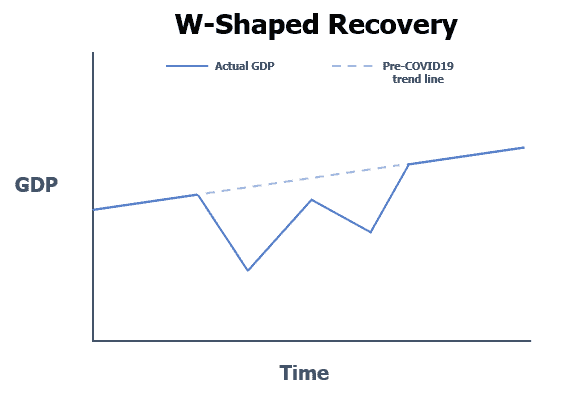

The W-Shaped Recovery – We spend less this quarter, start to recover, but experience a second economic downturn and recovery.

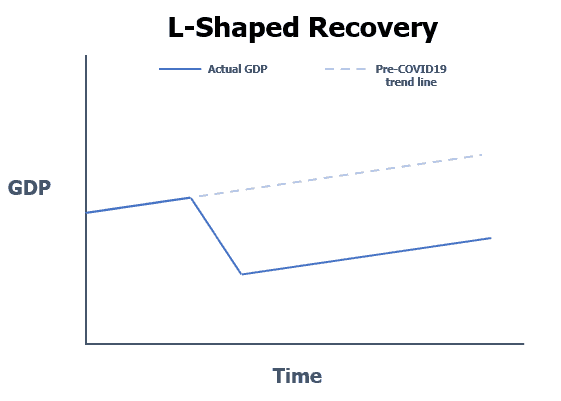

The L-Shaped Recovery – In this pessimistic scenario, there is no return to normal. The long term trend line for GDP stays depressed.

PDF of charts in this post

The Brookings Institute created a very nice post describing this shorthand called The ABC’s of the post-COVID economic recovery if you want to go into more depth on these different types of recoveries.

What are you going to do now? — How to get your team prepared for changes ahead

What are you going to do now? — How to get your team prepared for changes ahead